When you officially retire, you’re getting rid of one of the heaviest burdens we carry through life: the need to have a job.

But when you finally kick back and cast your working responsibilities aside, you might also want to toss out a few other things.

People are great at accumulating stuff, especially given decades of time. I’m not just talking about household items, either. You’d be surprised at how many work-related possessions will pile up over the course of 40 or 50 years. And past all that, there are other less conventional things that you might benefit from offloading.

Why? Well, many retirees choose to downsize their homes, and you probably wouldn’t want to pack one home’s worth of things into a home half the size. A few possessions can be sold for material gains that can bolster your funds in your post-career years. And hey—sometimes decluttering can be liberating.

Ready to lighten the load and add some weight to your wallet? Let’s discuss some of the best items to sell leading up to and during the early part of retirement.

Household Items to Discard Before Retirement

What you want out of retirement will differ from one person to the next—some people spend more time with their families, others seek out experiences, and still others focus on their hobbies.

But one thing many retirees will (or do) have in common is that they’ll have at least a few things they no longer use, need, or even want.

The following is a short list of the best things to get rid of before, or just after, you retire. Not only can doing so uncomplicate your life—but in certain cases, selling these items can result in a significant financial windfall.

I’ll start with smaller and/or mundane items, and work my way to more substantial goods.

1. Work Clothes

Dress codes vary substantially depending on your field and role within a company. If you worked a position that required formal attire you’re unlikely to need often in retirement, don’t delay in ditching at least some of your old work clothes lest they just collect dust in your closet.

If you plan to downsize in retirement, it’s likely you’ll be dealing with reduced closet space and less room for dressers and other storage. So it’s better to get rid of your clothes now rather than moving them all to a new location then sorting through the piles.

Even if you plan to age in place, it can be wise to sell your expensive work clothes for extra cash. Websites such as eBay, Mercari, and Poshmark make it easy to sell and ship attire you no longer need.

Lastly: I say some of your work clothes, rather than all, because you might want to keep a suit or two for weddings, funerals, and other formal events. There’s also the possibility you might decide to return to the workforce in retirement—and you won’t want to buy a whole new wardrobe to do so.

Related: Retired But Too Young for Medicare? Health Insurance for Early Retirees

2. Lunch Boxes + Briefcases

A few work accessories can probably hit the bricks, too.

If you always packed a lunch for work—good for you! That’s a more affordable option to grabbing lunch out every day. But in retirement, whether you eat at home or go out to eat, you probably won’t need to tote your midday meal around, which means your lunchbox can go.

The same goes if you still used a briefcase. Outside of the corporate world, there are very few uses for them. If you want to become more minimalist, this is an easy place to start.

3. Office Supplies

Did you work a lot from home? If so, you probably have more office supplies—from pens and Post-Its to shelves of industry books and bins full of binders—hanging around the house than your average person.

While you might want to keep a few extra pens around, many of these work-related supplies can get the heave-ho. But like with work clothes, you might not want to throw all of your office supplies away if you think there’s even a decent chance you’ll return to the workforce, even in a part-time capacity.

Still, if you worked from home, getting rid of a lot of home-office goods could free up a substantial amount of space. And if you have any equipment (say, a printer), selling it could make you a few bucks, too.

Related: How to Plan for Health Care Expenses in Retirement

4. Workplace Comfort + Job-Specific Items

Whether you had an in-person job or worked from home, you may have items you bought to make your body more comfortable during the workday. This could range from a $20 lumbar cushion for your long commute into work to a $1,000 standing desk to keep your neck and back healthy across hours of office work.

Meanwhile, certain jobs require specialized items, such as steel-toed boots for construction and manufacturing workers.

In any case, if you think your retirement will be all vacations and no vocations, you can get rid of that gear, freeing up room—and again, in the case of more expensive items, netting a little cash to sock away as well.

5. Duplicates

When you went into the office, were there certain items you couldn’t live without—so much so that you bought duplicates of those items to keep in or at your desk? They could’ve been as small as phone chargers, water bottles, or headphones, but you might have even bought yourself a mini-fridge or coffeemaker.

While those items might have made for a great workplace setup, those essential items will become largely redundant once you’re out of the office for good.

You still might want to keep a spare charger or even headphones, and they don’t take up much room anyways. But you should ditch duplicates you have no use for and save the counter and cabinet space.

Related: 10 Retirement Questions: Are You Ready to Leave the Workforce?

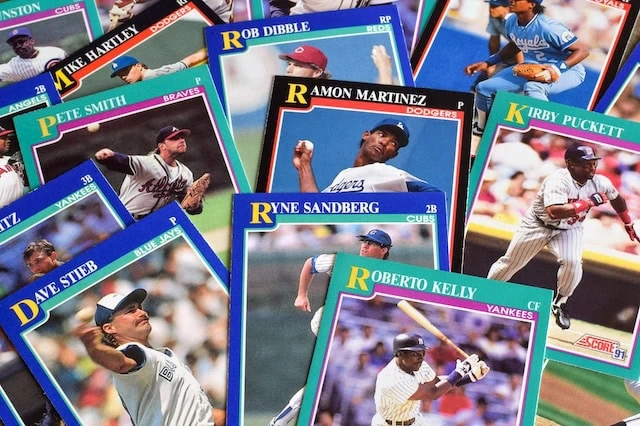

6. Collectibles

If you have a collection that brings you joy—whether it’s coins, comic books, trading cards or something else—there’s no reason to get rid of any of that before you’re forced to.

But if you’ve been collecting items with the hope of selling them for a profit in the future … well, the future might very well be here already. It’s a vague suggestion, of course—if you think a few more years could bring meaningful appreciation, by all means, ignore our advice and hang on—but it won’t hurt to at least re-evaluate whether it’s time to cash in on some of your collectible investments.

If you (unfortunately) missed the boat and didn’t sell a collection before its value peaked, take an honest assessment of what you have and ask yourself whether it’s time to call it quits.

And if you have children and plan to leave your collection as part of an inheritance? Have an open and frank conversation with them. Because your kids might not be as passionate about those items as you are.

7. Excess Furniture

Selling extra furniture is a particularly wise move for anyone who plans to move during retirement. If you’re downsizing, odds are you won’t have room for all of your current large belongings. If you part ways with some of that furniture before you change homes, that’s a little less money you’ll have to pay the movers—and if you’re able to sell that furniture, a little more money in your pocket.

Not moving? There are still benefits to selling furniture you don’t need. Again, well-made furniture can earn you a decent payday, especially if you aren’t in a rush to sell it and can wait for the right buyer. A room less cluttered with furniture is also easier to clean, and represents fewer hazards to run into once you reach an advanced age.

Related: 15 Alarming Gen X Retirement Statistics

8. Extra Vehicles

Do you and your spouse each have a designated vehicle? Do you have a pair of commuter vehicles and a third for fun? Do you have a fleet that would put Jay Leno to shame?

Retirement is an excellent time to re-evaluate your wheeled possessions.

Being a two-car household might have made a lot more sense when you were both commuting, but if your retirement driving is largely limited to the store, visiting family, and/or hitting the airport en route to your next cruise, you might not need that many vehicles anymore.

Selling a vehicle can net you a large lump sum that you could spend on home renovations, recreational activities, or simply padding your nest egg. Plus, you could cut the expense of insurance for that vehicle, leaving more room in your monthly budget.

Just make sure to consider all the possibilities when making this decision. For instance, if you own two older cars outright, you might not get a massive windfall out of selling either, while keeping both would ensure you at least have one functional vehicle if the other is in the shop.

9. Your House (Sometimes)

The decision about whether to move during retirement largely depends on personal preferences, but there are a few undeniable financial benefits worth considering.

For one, selling your home to downsize can net you a substantial amount of money in a swift lump sum. Moving to a location with a lower cost of living won’t come with an immediate windfall, but the savings over time could make a significant difference in your retirement budget. Moreover, a few states don’t tax retirement income, so selling your house to live there could keep some of your money out of the IRS’s mitts.

Related: Beyond Roadside Assistance: 10 AAA Discounts You May Not Know About

10. Some of Your Higher-Risk Investments

If you’ve had any sort of established financial plan heading into retirement, you’ve already been gradually adjusting your portfolio away from wealth generation and toward wealth preservation.

Put differently: You’ve probably been selling off some riskier growth investments and buying more stable defensive investments.

But if you haven’t, now might very well be the time.

Portfolio losses affect investors differently depending on their age. If you’re young, you can afford to be aggressive because if you do lose money, you have a lot of time in which to make up your returns. But as you near retirement, and especially once you’re in retirement, a big drop in stocks can substantially reduce the nest egg you’ll use to fund all of your living expenses.

If you don’t already have a plan, talk to a financial advisor about your financial situation to determine what, if any, adjustments you should make.